Whereas Pitakkorn/iStock by way of Getty Photos

This month-to-month sequence of articles contains a dashboard of aggregated business indicators within the subject of communications expertise and providers. It could actually additionally function a top-down evaluation of sector ETFs such because the Vanguard Data Expertise ETF (VGT), Expertise Choose Sector SPDR ETF (XLK) and the iShares US Expertise ETF (HURRY), whose largest holdings are used to calculate these indicators. This month’s article can be devoted Invesco Dorsey Wright Expertise Momentum ETF (NASDAQ: PTF).

Shortcut

The subsequent two paragraphs describe the dashboard methodology in italics. New readers want them to grasp the metrics. In case you are used to this sequence or you’re quick on time, you’ll be able to skip them and go to the charts.

Primary metric

I calculate the common of 5 elementary ratios for every business: return on earnings (“EY”), return on gross sales (“SY”), return on free money movement (“FY”), return on fairness (“ROE”), gross margin (” GM”). Reference universe consists of main firms on the US inventory market. 5 primary indicators are calculated for the final 12 months. Higher than above for all of them. EY, SY, and FY are the medians of the backwardation of worth/earnings, worth/gross sales, and worth/free money movement. They’re higher suited to statistical analysis than price-to-something ratios, that are inappropriate or unavailable when the “one thing” is near zero or adverse (corresponding to firms with adverse earnings). I additionally have a look at two measures of momentum for every group: common month-to-month earnings (RetM) and common annual earnings (RetY).

I favor the median to the imply as a result of the median divides the set into an excellent half and a foul half. Fairness-weighted common is skewed by excessive values and largest firms. My indicators are for inventory choosing, not index investing.

Worth and high quality indicators

I calculate historic baselines for all metrics. They’re labeled EYh, SYh, FYh, ROEh, GMh, respectively, and are calculated as averages over a evaluate interval of 11 years. For instance, the EYh worth for {hardware} within the desk under is a mean of 11 years of common earnings for {hardware} firms.

The worth index (VS) is outlined as the common % distinction between the three analysis components (EY, SY, FY) and their baselines (EYh, SYh, FYh). Likewise, the High quality Rating (“QS”) is the common distinction between two high quality measures (ROE, GM) and their baselines (ROEh, GMh).

Scores in share factors. VS might be interpreted as a share of underestimation or overestimation relative to the baseline (optimistic is sweet, adverse is unhealthy). This interpretation must be taken with warning: the baseline is an arbitrary reference, not an estimated honest worth. The components assumes that the three analysis metrics are of equal significance.

Precise knowledge

The next desk exhibits the figures and scores on the time of writing. The columns symbolize all the information outlined above.

towards | QS | EY | SY | FY | ROE | GM | Eh | Mr | FYh | Roe | GMh | RetM | RetY | |

Tools | -50.27 | -19.05 | 0.0031 | 0.4966 | 0.0324 | 4.82 | 34.32 | 0.0338 | 0.9557 | 0.0368 | 6.22 | 40.68 | 6.52% | 73.63% |

Communicator. Equip. | -12.29 | 8.99 | 0.0223 | 0.2924 | 0.0307 | 19.97 | 61.02 | 0.0311 | 0.2648 | 0.0379 | 16.53 | 62.80 | 7.71% | 6.26% |

Digital tools. | -7.61 | 5.17 | 0.0350 | 0.4797 | 0.0474 | 16.76 | 29.59 | 0.0395 | 0.7441 | 0.0382 | 13.37 | 34.81 | 8.29% | 23.53% |

software program | -18.65 | 10.59 | 0.0217 | 0.1204 | 0.0257 | 22.84 | 81.95 | 0.0246 | 0.1554 | 0.0328 | 18.21 | 85.59 | 3.30% | 21.75% |

Semiconductors | -39.68 | 6.73 | 0.0297 | 0.1328 | 0.0171 | 28.96 | 60,72 | 0.0438 | 0.2224 | 0.0320 | 24.90 | 62.49 | 5.29% | 31.37% |

IT providers | -20.63 | 14.89 | 0.0363 | 0.1775 | 0.0240 | 33.55 | 58.74 | 0.0364 | 0.2987 | 0.0304 | 27.17 | 55,26 | 3.73% | 14.97% |

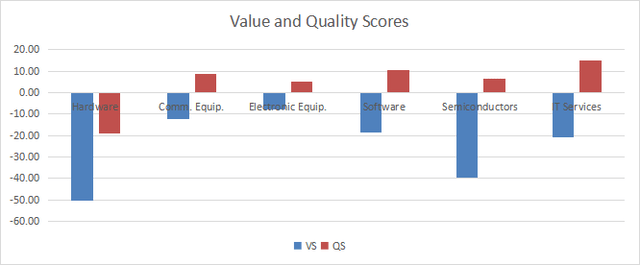

Value and high quality chart

The next chart exhibits worth for cash by business (the upper the higher).

Worth and High quality in Expertise (Chart: writer; knowledge: Portfolio123)

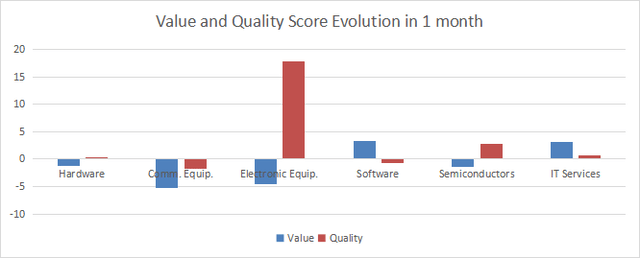

Evolution since final month

The standard of digital tools has improved.

Rating variations (Chart: writer; knowledge: Portfolio123)

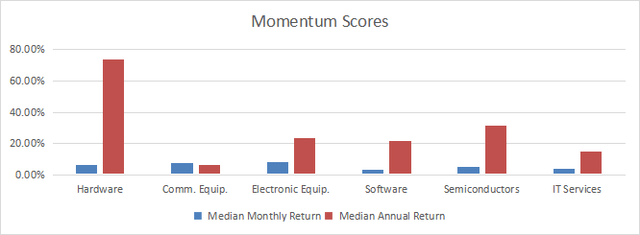

Impulse

The next chart shows momentum estimates primarily based on common returns.

Momentum in Expertise (chart: writer; knowledge: Portfolio123)

Interpretation

Based mostly on my month-to-month S&P 500 dashboard, info expertise is likely one of the two most overvalued sectors within the GICS, together with industrials. Nonetheless, the electronics business is near its 11-year averages in each valuation and high quality. Communications tools, software program and IT providers are reasonably overvalued, by 12%-21% relative to their historic baselines. The semiconductor and {hardware} industries are deeply overvalued. The latter additionally has the worst high quality rating.

Give attention to PTF

The Invesco Dorsey Wright Expertise Momentum ETF started buying and selling on 10/12/2006 and tracks the Dorsey Wright Expertise Expertise Leaders Index. It has 39 holdings and a internet expense ratio of 0.60%. Fairness-weighted expertise ETFs like VGT and XLK have less expensive administration charges (0.10% and 0.09%, respectively). The underlying index selects and weights constituents utilizing a rating primarily based on relative worth energy, and is rebalanced quarterly. The mixed weight of the 5 largest holdings is restricted to 25%.

The fund is obese software program firms (47.3% of asset worth). Nonetheless, this isn’t a structural attribute of the technique and the business breakdown could change over time. The portfolio is pretty concentrated, with the highest 10 holdings listed under with elementary ratios accounting for a mixed 42.1% of property. Nonetheless, no single element weighs greater than 5%, so the dangers related to particular person firms are average.

Ticker | Identify | weight % | EPS Progress %TTM | P/E TTM | Ahead P/E | yield % |

THE PROGRAM | AppLovin Corp. | 4.91 | 859.93 | 49.44 | 28.80 | 0 |

NVDA | NVIDIA Corp. | 4.75 | 585.45 | 76.54 | 36.62 | 0.02 |

DELL | Dell Applied sciences, Inc. | 4.44 | 35.76 | 30.72 | 17.67 | 1.33 |

CLUTCH | KLA Corp. | 4.27 | -22.19 | 38.25 | 31.25 | 0.79 |

Aneta | Arista Networks, Inc. | 4.27 | 49.50 | 43.63 | 39.71 | 0 |

AVGO | Broadcom Inc. | 4.10 | -8.30 | 51.15 | 29.18 | 1.52 |

CDNS | Cadence Design Programs, Inc. | 4.10 | 22.90 | 73.83 | 47.77 | 0 |

FICO | Truthful Isaac Corp. | 4.09 | 27.09 | 71.05 | 57.36 | 0 |

NTNX | Nutanix, Inc. | 3.90 | 83.57 | N/A | 62,66 | 0 |

SNPS | Synopsys, Inc. | 3.29 | 50.01 | 61,63 | 41.78 | 0 |

Since inception, PTF has underperformed XLK by roughly 3.5% when it comes to annualized returns. It additionally exhibits increased threat as measured in the usual deviation of month-to-month returns (“volatility” within the desk under).

Full return | Annual earnings | Drawdown | Sharp | Volatility | |

PTF | 586.14% | 11.58% | -55.38% | 0.52 | 23.29% |

XLK | 1076.21% | 15.06% | -53.04% | 0.76 | 18.67% |

Nonetheless, PTF has outperformed the sector benchmark over the previous 5 years as reported within the following chart. It once more exhibits excessive volatility.

PTF vs XLK, 5 Yr Return (Looking for Alpha)

PTF doesn’t look engaging as a long-term funding as a result of historic efficiency and excessive threat. Nonetheless, excessive volatility might be a bonus for traders in search of a swing buying and selling instrument within the expertise sector.

Dashboard record

I take advantage of the primary desk to calculate price and high quality. It will also be used within the inventory choosing course of to test how firms stack up amongst their friends. For instance, the EY column reviews {that a} semiconductor firm with a worth/earnings ratio above 0.0297 (or a worth/earnings under 33.67) is one of the best half of the business by this metric. Every month, a dashboard record of probably the most worthwhile firms which might be within the prime half of their friends for 3 valuation metrics is distributed out concurrently. The shares under are a part of a listing despatched a number of weeks in the past, primarily based on the information out there presently.

ECTR | Excessive Networks, Inc. |

JBL | Jabil, Inc. |

CARS | Vehicles.com, Inc. |

ACLS | Axcelis Applied sciences, Inc. |

NXPI | NXP Semiconductors NV |

GEN | Gen Digital Inc. |

IDCC | InterDigital, Inc. |

It is a rotational mannequin with a statistical bias in direction of extra returns over the long run, not the results of an evaluation of every inventory.